How to Convert Your Ordinary Monthly Expenses into Free Airfare

I want to show you how to convert your ordinary monthly expenses into free airfare. Airfare costs continue to soar, making travel an expensive luxury for many. However, what if there was a way to turn your everyday expenses into free flights? In this guide, I will explore the art of converting your ordinary monthly expenses into valuable airline miles and points, unlocking the door to a world of affordable travel.

Understanding Airline Miles and Points

Airline miles and points are the currency of modern travel. They function as a reward system offered by airlines and credit card companies, allowing you to earn and redeem them for flights, hotel stays, and more. Loyalty programs play a crucial role, offering perks and exclusive benefits to frequent travelers.

Assessing Your Monthly Expenses

Before you can start accumulating miles, take a closer look at your monthly expenses. From groceries and utilities to entertainment and dining, every dollar spent is an opportunity to earn rewards. Identifying areas where you can optimize your spending is the first step towards free airfare.

Before you embark on the journey of turning your ordinary monthly expenses into free airfare, it’s crucial to conduct a thorough assessment of your spending habits. Identifying areas where you can optimize and strategize will set the foundation for a successful travel rewards plan.

1. Categorizing Your Expenses

Also Read : How to travel and stay in foreign homes for free.

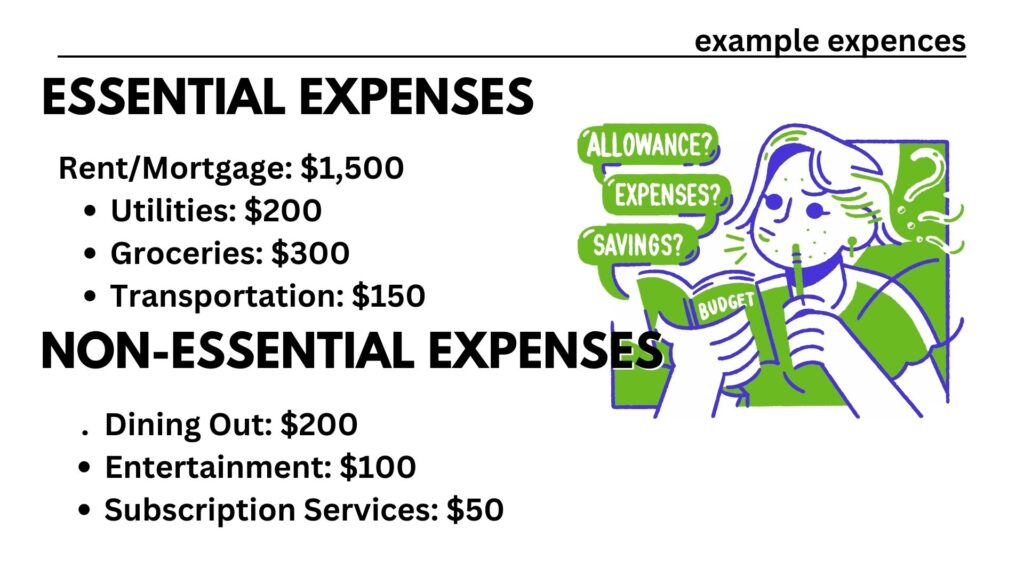

Start by categorizing your monthly expenses into essential and non-essential items. Essential expenses include rent or mortgage, utilities, groceries, and transportation. Non-essential items may include dining out, entertainment, and subscription services. This categorization helps you understand where your money is going and where potential savings can be made.

Example:

- Essential Expenses

- Rent/Mortgage: $1,500

- Utilities: $200

- Groceries: $300

- Transportation: $150

- Non-Essential Expenses

- Dining Out: $200

- Entertainment: $100

- Subscription Services: $50

2. Analyzing Spending Patterns

Once you’ve categorized your expenses, delve deeper into your spending patterns. Look for trends, such as peak spending months or consistent high-cost categories. Understanding your habits helps you identify areas where you can potentially cut back or find more cost-effective alternatives.

Example:

- Peak Spending Months

- December (holiday expenses): $500

- July (summer vacations): $400

- High-Cost Categories

- Entertainment (concerts, movies): $150

- Dining Out: $200

- Dining Out: $200

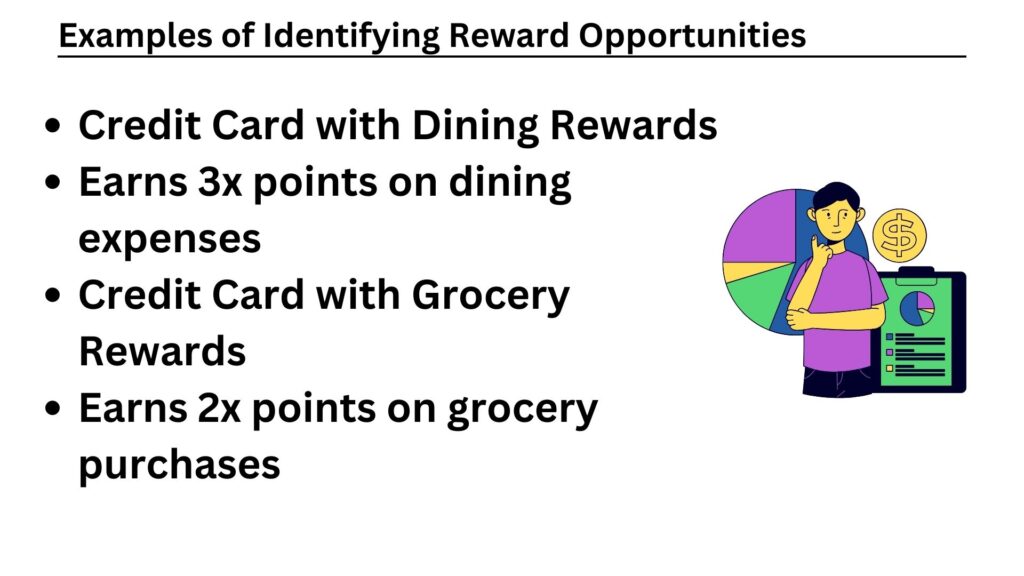

3. Identifying Reward Opportunities

Certain expenses present excellent opportunities for earning rewards. Investigate credit cards that offer bonus points for specific categories like dining, groceries, or travel-related expenses. By aligning your credit card choices with your high-spending categories, you can maximize your rewards potential.

Example:

- Credit Card with Dining Rewards

- Earns 3x points on dining expenses

- Credit Card with Grocery Rewards

- Earns 2x points on grocery purchases

4. Cutting Unnecessary Expenses

Consider eliminating or reducing unnecessary expenses that don’t align with your travel goals. Small sacrifices in non-essential areas can contribute significantly to your travel fund over time. Redirect the money saved towards your dedicated travel budget.

Example:

- Canceling Unused Subscription Services: $50 savings per month

5. Creating a Travel Budget Allocation

Allocate a specific percentage of your monthly budget explicitly for travel. This dedicated fund ensures that you consistently contribute to your travel goals, turning it into a non-negotiable expense.

Example:

- Travel Budget Allocation: 10% of monthly income

By assessing your monthly expenses with a keen eye for detail, you lay the groundwork for a tailored strategy to convert these expenses into valuable airline miles and points. This proactive approach ensures that every dollar spent contributes to your travel aspirations, bringing you closer to the thrill of free airfare.

Choosing the Right Credit Card

Not all credit cards are created equal when it comes to travel rewards. Research and choose a credit card that aligns with your spending habits and travel goals. Consider factors like sign-up bonuses, annual fees, and reward structures to find the perfect match for your financial strategy.

Selecting the right credit card is a pivotal step in your journey to convert ordinary monthly expenses into free airfare. Each credit card comes with its own set of perks, fees, and rewards structures, so it’s essential to choose one that aligns with your spending habits and travel goals.

1. Researching Travel Rewards Cards

Start by researching credit cards that are specifically designed for travel rewards. Look for cards offered by major airlines, as well as general travel rewards cards that provide flexibility in redeeming points across multiple airlines.

Example:

- Delta SkyMiles Platinum American Express Card

- Earns 3x miles on Delta purchases

- Complimentary companion certificate annually

- Complimentary companion certificate annually

2. Understanding Sign-Up Bonuses

Many travel rewards cards offer enticing sign-up bonuses to attract new cardholders. These bonuses can provide a significant boost to your miles balance when you meet the specified spending requirements within the designated timeframe.

Example:

- Sign-Up Bonus: 50,000 miles after spending $3,000 in the first three months

3. Evaluating Annual Fees

While some travel rewards cards come with annual fees, they often offer valuable benefits that can outweigh the cost. Evaluate whether the card’s perks, such as lounge access, travel credits, or insurance coverage, justify the annual fee.

Example:

- Annual Fee: $95

- Benefits: Priority boarding, free checked bag, and $100 Delta flight credit

4. Considering Reward Structures

Different credit cards offer varied reward structures, with some providing bonus points for specific categories like travel, dining, or groceries. Choose a card that aligns with your highest spending categories to maximize your rewards potential.

Example:

- Chase Sapphire Preferred Card

- Earns 2x points on dining and travel

5. Factoring in Foreign Transaction Fees

If you plan to use your credit card for international travel, be mindful of foreign transaction fees. Opt for a card that waives these fees to ensure you’re not losing money on currency conversions.

Example:

- Foreign Transaction Fee: None

6. Reading User Reviews

Before finalizing your decision, read user reviews to understand the experiences of other cardholders. Pay attention to feedback on customer service, ease of point redemption, and any potential drawbacks.

Example:

- Positive Reviews: Easy point redemption process and excellent customer service

7. Checking for Transfer Partners

Some credit card programs allow you to transfer your points to partner airlines, potentially unlocking more value. Check for a card with a diverse range of transfer partners to expand your travel options.

Example:

- Transfer Partners: Delta, Air France, KLM, and more

8. Examining Credit Score Requirements

Ensure that you meet the credit score requirements for the card you’re interested in. Applying for cards that align with your current credit profile increases the likelihood of approval.

Example:

- Credit Score Requirement: 700 and above

9. Seeking Referral Bonuses

Many credit cards offer referral bonuses for cardholders who refer friends or family. Utilize these bonuses to earn additional points and enhance your travel rewards strategy.

Example:

- Referral Bonus: 10,000 points for each successful referral

Choosing the right credit card requires careful consideration of various factors. By researching thoroughly and aligning the card’s features with your spending habits and travel aspirations, you can maximize your rewards potential and embark on a journey where your everyday expenses pave the way to free airfare.

Maximizing Rewards on Everyday Spending

Once armed with the right credit card, it’s time to maximize your rewards. Learn the ins and outs of bonus categories and strategically use your card for everyday purchases. From groceries to gas, every transaction can contribute to your travel fund.

Once you’ve chosen the right credit card for your travel goals, the next step is to maximize your rewards on everyday spending. By strategically using your credit card for daily purchases, you can accumulate points and miles faster, bringing you closer to the dream of free airfare.

1. Understanding Bonus Categories

Many credit cards offer bonus points for specific spending categories such as dining, groceries, and travel. Familiarize yourself with these bonus categories and tailor your spending to capitalize on the higher point-earning opportunities.

Example:

- Chase Freedom Card

- Rotating quarterly bonus categories (e.g., 5% cash back on groceries during certain months)

2. Dedicated Card for Specific Categories

Consider using a specific credit card for certain categories to maximize rewards. For instance, if you have a card that earns extra points on dining, use it exclusively when dining out to ensure you’re getting the most out of your spending.

Example:

- American Express Gold Card

- Earns 4x points on restaurants worldwide

3. Online Shopping Portals

Explore online shopping portals associated with your credit card. These portals offer additional points for making purchases through affiliated retailers, providing an easy way to boost your rewards without changing your spending habits.

Example:

- Chase Ultimate Rewards Mall

- Earn extra points for online purchases from partner retailers

4. Autopay Utilities and Subscriptions

Set up autopay for your utility bills and subscription services using your rewards credit card. This way, you effortlessly earn points on essential expenses without any additional effort.

Example:

- Linking Netflix and utility bills to your credit card for automatic payments

5. Paying Rent or Mortgage with a Service

Look for services that allow you to pay your rent or mortgage with a credit card. While some may charge a fee, the points earned could outweigh the cost, contributing to your travel fund.

Example:

- Third-party services like Plastiq that enable credit card payments for rent

6. Stack Discounts and Rewards

Combine discounts, cashback offers, and credit card rewards to maximize savings. This strategy involves using your credit card for a purchase during a promotion, earning points on the total amount, and potentially enjoying additional discounts.

Example:

- Making a purchase during a retailer’s promotion with a credit card that earns bonus points at that specific retailer

7. Consider Contactless and Mobile Payments

Many credit cards offer bonus points for using contactless or mobile payments. Embrace these technologies to earn extra points on your transactions.

Example:

- Using Apple Pay or Google Pay with a card that rewards mobile payments

8. Utilize Family or Group Expenses

If you share expenses with family or friends, consolidate spending on your rewards credit card. Pooling expenses allows you to accumulate points faster than if everyone used separate payment methods.

Example:

- Paying for group dinners or travel expenses and collecting money from others

9. Strategic Use of Business Expenses

If you have a small business, use a business credit card for eligible expenses. Business cards often come with unique bonus categories tailored to business spending.

Example:

- Using a business credit card for office supplies or travel related to your business

10. Reviewing Monthly Statements

Regularly review your credit card statements to ensure that all eligible purchases are earning points. Identify any missed opportunities and adjust your spending habits accordingly.

Example:

- Checking statements for missed bonus points on certain transactions

By incorporating these strategies into your daily life, you can effortlessly maximize rewards on your everyday spending. The key is to be intentional about how you use your credit card, ensuring that each purchase contributes significantly to your growing stash of points and miles, bringing your dream of free airfare closer to reality.

Travel Hacking Strategies

Travel hacking is the art of leveraging promotions, bonuses, and loopholes to accumulate points rapidly. Stay informed about limited-time offers, and be strategic in your spending to take advantage of these opportunities. Travel hacking can significantly expedite your journey to free airfare.

Travel hacking is the art of using creative and strategic techniques to accumulate points and miles quickly, enabling you to enjoy free or significantly discounted travel. By employing these savvy strategies, you can expedite your journey toward converting ordinary monthly expenses into valuable airline miles.

1. Capitalize on Sign-Up Bonuses

One of the most effective travel hacking strategies is taking advantage of credit card sign-up bonuses. These bonuses often provide a substantial influx of points or miles when you meet specific spending requirements within a specified timeframe.

Example:

- Sign-Up Bonus: 60,000 miles after spending $4,000 in the first three months

2. Leverage Multiple Credit Cards

Diversify your credit card portfolio to maximize rewards across different spending categories. Combining cards with specific bonuses for groceries, dining, and travel allows you to earn more points on a broader range of expenses.

Example:

- Using a card with bonus points on dining for restaurant expenses, and another with travel bonuses for vacation-related spending

3. Take Advantage of Transferable Points

Choose credit cards that offer transferable points, allowing you to move your rewards to various airline and hotel partners. This flexibility expands your redemption options and often provides better value for your points.

Example:

- Chase Ultimate Rewards points can be transferred to partners such as United Airlines, Southwest, and Hyatt

4. Utilize Shopping Portals and Promotions

Many travel rewards programs have online shopping portals that offer bonus points for purchases made through affiliated retailers. Additionally, keep an eye on promotions that provide extra points for specific spending categories or during limited-time offers.

Example:

- Earn extra points by shopping through the airline’s online portal during a promotion

5. Strategic Use of Companion Passes

Certain credit cards and loyalty programs offer companion passes, allowing a friend or family member to travel with you for a reduced or even free fare. Attaining and strategically using these passes can significantly enhance the value of your travel rewards.

Example:

- Southwest Airlines Companion Pass allows a designated companion to fly for free (excluding taxes) for the remainder of the current year and the following year

6. Participate in Status Matches and Challenges

Some airlines and hotel chains offer status matches or challenges, allowing you to attain elite status by demonstrating your status with a competitor. This elevated status comes with perks like priority boarding, complimentary upgrades, and additional bonus points.

Example:

- Requesting a status match with an airline by showing your elite status with another airline

7. Capitalize on Promotional Offers and Amex Offers

Keep an eye on promotional offers from credit card issuers and loyalty programs. Additionally, take advantage of American Express (Amex) Offers, which provide statement credits or bonus points for specific purchases with participating merchants.

Example:

- Amex Offer: Spend $100 at a specific hotel chain and receive a $20 statement credit

8. Explore Manufactured Spending

Manufactured spending involves using techniques to increase credit card spending artificially. While this strategy requires caution and adherence to terms and conditions, it can help you meet minimum spending requirements for sign-up bonuses.

Example:

- Using prepaid cards or money orders to meet spending requirements without incurring additional expenses

9. Stay Informed about Limited-Time Promotions

Stay vigilant for limited-time promotions from airlines, hotels, and credit card issuers. These promotions often include bonus point offers, discounted award redemptions, or exclusive benefits.

Example:

- An airline offering double points for specific routes during a limited promotional period

10. Utilize Referral Programs

Many credit cards and loyalty programs offer referral bonuses for referring friends or family. Take advantage of these programs to earn additional points or miles.

Example:

- Referring a friend to a credit card and receiving bonus points once they are approved

By incorporating these travel hacking strategies into your overall approach, you can supercharge your efforts to accumulate points and miles. Remember to stay informed, be strategic in your choices, and always adhere to responsible financial practices to make the most of these travel rewards opportunities.

Budgeting for Travel

Allocate a portion of your monthly budget specifically for travel. By treating travel as a non-negotiable expense, you’ll prioritize building your travel fund. Set realistic goals and adjust your budget to accommodate your wanderlust.

Creating a dedicated budget for travel is a crucial step in turning your ordinary monthly expenses into free airfare. By allocating a specific portion of your income to travel-related expenses, you not only make travel a financial priority but also ensure that you’re consistently contributing to your wanderlust fund.

1. Assessing Financial Capacity

Before diving into the specifics of a travel budget, assess your overall financial capacity. Understand your monthly income, fixed expenses, and discretionary spending. This foundational understanding allows you to determine a realistic amount to allocate for travel without compromising your financial stability.

Example:

- Monthly Income: $5,000

- Fixed Expenses (Rent, Utilities, etc.): $2,000

- Discretionary Spending (Groceries, Entertainment, etc.): $1,500

- Remaining Capacity for Travel Budget: $1,500

2. Setting Realistic Travel Goals

Define your travel goals to guide your budgeting efforts. Whether it’s a weekend getaway, an international adventure, or a series of small trips throughout the year, having clear goals helps you establish a purposeful budget aligned with your travel aspirations.

Example:

- Travel Goal: A week-long vacation to Europe within the next 12 months

3. Determining Monthly Travel Allocation

Based on your financial assessment and travel goals, determine a reasonable monthly allocation for your travel fund. This amount should strike a balance between your desire to travel and your other financial priorities.

Example:

- Monthly Travel Allocation: $125 (contributing to a yearly travel budget of $1,500)

4. Creating a Separate Travel Fund

To maintain transparency and discipline, consider creating a separate bank account or fund specifically designated for travel. This segregation ensures that you don’t accidentally dip into your travel budget for other expenses.

Example:

- Opening a separate savings account labeled “Travel Fund”

5. Adjusting Other Spending Categories

If your initial travel allocation seems challenging, review other spending categories in your discretionary budget. Identifying areas where you can make adjustments, even if minor, can free up additional funds for your travel budget.

Example:

- Reducing dining out expenses by cooking at home more frequently

6. Exploring Cost-Cutting Measures

Look for ways to reduce the cost of your travel without compromising the experience. This could include opting for budget-friendly accommodations, exploring destinations with favorable exchange rates, or taking advantage of travel deals and promotions.

Example:

- Choosing a mid-range hotel with positive reviews instead of a luxury resort

7. Incorporating Travel Insurance Costs

Factor in the cost of travel insurance when budgeting for your trips. While it may seem like an additional expense, travel insurance provides crucial financial protection in case of unexpected events, giving you peace of mind during your adventures.

Example:

- Allocating $50 per trip for comprehensive travel insurance coverage

8. Adjusting the Budget for Special Trips

For special trips, such as milestone celebrations or dream vacations, consider adjusting your monthly travel budget temporarily. This allows you to accumulate a more substantial travel fund for those extraordinary experiences.

Example:

- Increasing monthly travel allocation to $200 for three months leading up to a special trip

9. Tracking Expenses During Travel

Once on your journey, diligently track your expenses. This not only helps you stay within your budget but also provides insights for future trips. Utilize budgeting apps or a simple spreadsheet to record all expenditures.

Example:

- Recording daily expenses, including meals, activities, and transportation, in a travel expense tracker

10. Adjusting the Budget After Each Trip

After returning from a trip, evaluate your spending against your budget. Take note of any unexpected expenses or areas where you overspent. Use this information to refine and adjust your future travel budgets for more accurate planning.

Example:

- Noting that transportation costs were higher than expected, leading to an adjustment in the transportation budget for the next trip

By implementing these budgeting strategies and incorporating real-world examples, you can ensure that your travel aspirations align harmoniously with your financial reality. A well-thought-out travel budget not only makes your dreams of free airfare achievable but also instills financial discipline, allowing you to enjoy your adventures without the burden of financial stress.

Avoiding Common Pitfalls

While the allure of free airfare is enticing, it’s essential to navigate this terrain responsibly. Use credit cards wisely, be mindful of fees and interest rates, and avoid falling into debt. Responsible financial habits are key to a successful travel rewards strategy.

While the prospect of turning ordinary monthly expenses into free airfare is exciting, it’s essential to navigate the world of travel rewards with caution. Avoiding common pitfalls ensures that your journey to accumulating points and miles remains a positive and financially responsible one.

1. Responsible Credit Card Use

One of the most significant pitfalls in the realm of travel rewards is irresponsible credit card use. While credit cards offer fantastic benefits, accruing debt through overspending or carrying a balance can quickly negate the value of any rewards earned.

Example:

- Pitfall: Maxing out a credit card to meet a sign-up bonus spending requirement and being unable to pay off the balance in full.

2. Ignoring Annual Fees

Many travel rewards credit cards come with annual fees. While the perks and rewards may outweigh the cost, it’s crucial to assess whether the card’s benefits justify the annual fee. Ignoring this consideration can lead to unnecessary expenses.

Example:

- Pitfall: Keeping a card with a high annual fee without utilizing its benefits, resulting in a net loss.

3. Overlooking Interest Rates

Travel rewards cards often have higher interest rates than standard credit cards. Failing to pay the balance in full each month can lead to substantial interest charges, eroding the value of the earned rewards.

Example:

- Pitfall: Carrying a balance on a rewards card with a high-interest rate, resulting in significant interest payments.

4. Neglecting to Track Points and Miles

Failure to monitor your points and miles can lead to missed opportunities and expired rewards. Loyalty programs may have expiration dates, and overlooking this detail can result in the loss of hard-earned rewards.

Example:

- Pitfall: Allowing airline miles to expire due to inactivity, missing out on potential free flights.

5. Chasing Sign-Up Bonuses Without a Plan

While sign-up bonuses are enticing, chasing them without a clear plan can lead to haphazard spending and potential debt. It’s crucial to integrate sign-up bonuses into a comprehensive travel strategy.

Example:

- Pitfall: Applying for multiple credit cards simultaneously solely for sign-up bonuses, leading to unmanageable spending requirements.

6. Focusing Solely on Points and Ignoring Fees

Some reward programs may have hidden fees or redemption costs that diminish the value of accumulated points. It’s vital to be aware of any fees associated with booking flights or redeeming rewards.

Example:

- Pitfall: Redeeming points for a flight but facing high taxes and fees, diminishing the perceived value of the reward.

7. Neglecting to Optimize Bonus Categories

Credit cards often offer bonus points for specific spending categories. Neglecting to optimize your spending in these categories means missing out on valuable rewards.

Example:

- Pitfall: Using a general-purpose card for dining instead of one that offers bonus points for restaurant expenses.

8. Overspending to Earn Rewards

It’s easy to fall into the trap of overspending with the goal of earning more rewards. However, this can lead to financial strain and negate the benefits of any accumulated points.

Example:

- Pitfall: Spending beyond your means to reach a specific rewards threshold, resulting in financial stress.

9. Closing Credit Card Accounts Without a Plan

Closing a credit card account can impact your credit score and disrupt your credit history. Before closing an account, consider the potential consequences and have a plan for maintaining a healthy credit profile.

Example:

- Pitfall: Closing a credit card account without understanding the impact on credit utilization and credit history.

10. Falling for Impulse Redemptions

Impulse redemptions may not provide the best value for your points. It’s essential to resist the urge to redeem points hastily and instead strategize for maximum value.

Example:

- Pitfall: Redeeming points for a suboptimal reward because of a last-minute decision, missing out on a more valuable redemption option.

By steering clear of these common pitfalls and integrating responsible practices into your travel rewards journey, you can ensure that your efforts result in meaningful and valuable experiences. Approach the world of travel rewards with mindfulness and strategic planning to make the most of your financial and travel endeavors.

Tracking and Managing Points

Keep a close eye on your accumulated points and miles using dedicated apps and tools. Stay organized with a spreadsheet or utilize loyalty program dashboards to ensure you don’t miss out on potential redemptions.

Effectively tracking and managing your points and miles is crucial in the world of travel rewards. By maintaining a organized system, you can ensure that your hard-earned rewards are maximized, preventing points from expiring and providing a clear picture of your progress toward free airfare.

1. Utilize Loyalty Program Dashboards

Most airlines and credit card issuers provide online dashboards where you can easily track your points and miles. Regularly log in to these platforms to check your balances, review recent transactions, and explore redemption options.

Example:

- Utilizing the Delta SkyMiles dashboard to view current miles, upcoming flights, and available promotions.

2. Consolidate Points in One Place

If you have multiple credit cards or participate in various loyalty programs, consider using a points aggregator or a travel rewards app to consolidate all your points in one place. This simplifies tracking and helps you avoid overlooking any balances.

Example:

- Using a tool like AwardWallet to consolidate and track points from different loyalty programs.

3. Set Up Alerts for Expiring Points

Many loyalty programs have expiration policies for unused points. Set up alerts or reminders to notify you before points are set to expire. This proactive approach ensures you have the chance to use or extend your points before they lapse.

Example:

- Creating a calendar reminder to check and redeem points before they expire.

4. Maintain a Spreadsheet or Travel Journal

For those who prefer a more hands-on approach, maintain a spreadsheet or travel journal to manually track your points and miles. Include details such as the source of the points, expiration dates, and any upcoming travel plans.

Example:

- Creating a Google Sheets document to log points, including dates earned, expiry information, and redemption history.

5. Use Point-Tracking Apps

Numerous mobile apps are designed specifically for tracking and managing travel rewards. These apps often synchronize with your loyalty program accounts, providing real-time updates on your points, upcoming promotions, and redemption options.

Example:

- Downloading the Points Tracker app to receive notifications about point balances and potential promotions.

6. Monitor Credit Card Statements

Regularly review your credit card statements to ensure that earned points are correctly reflected. Check for any discrepancies or missing points and promptly contact the credit card issuer if you notice any issues.

Example:

- Scanning monthly credit card statements to verify that bonus points for specific spending categories are accurately credited.

7. Join Frequent Flyer and Travel Forums

Participate in frequent flyer and travel forums where members often share tips, strategies, and updates on the latest promotions. These communities can provide valuable insights into maximizing points and staying informed about program changes.

Example:

- Joining the FlyerTalk forum to stay updated on the latest developments in the world of travel rewards.

8. Regularly Check for Promotions and Bonuses

Loyalty programs frequently offer promotions and bonuses that can boost your points balance. Regularly check for these opportunities on program websites, newsletters, or through targeted emails.

Example:

- Subscribing to email newsletters from loyalty programs to receive notifications about limited-time promotions.

9. Assess Redemption Value

Understanding the value of your points is crucial. Evaluate different redemption options to ensure you’re using your points efficiently and getting the best value for your travel experiences.

Example:

- Comparing the value of redeeming points for a flight versus using them for hotel stays to maximize value.

10. Adjust Your Strategy Based on Changes

Loyalty programs and credit card benefits can undergo changes. Stay informed about any alterations to program rules, point values, or credit card terms, and adjust your strategy accordingly.

Example:

- Adapting your spending habits and loyalty program participation based on changes to credit card rewards or airline policies.

By implementing these tracking and managing strategies, you can stay on top of your travel rewards game, ensuring that your points and miles are used strategically and efficiently. This level of organization not only enhances your ability to enjoy free airfare but also allows you to navigate the evolving landscape of travel rewards with confidence.

Redeeming Airline Miles

Understanding the redemption options available is crucial. Whether it’s booking flights, upgrading seats, or enjoying hotel stays, explore the full range of possibilities. Learn the art of maximizing the value of your miles for the best travel experience.

Redeeming airline miles is the exciting culmination of your efforts in the world of travel rewards. Whether you’ve earned miles through frequent flying, credit card spending, or various promotions, strategically redeeming them can unlock incredible travel experiences. Here’s a detailed guide, including examples, on how to make the most of your accumulated airline miles.

1. Understanding Redemption Options

Before diving into the redemption process, familiarize yourself with the various options available. Airline miles can typically be used for flights, seat upgrades, hotel stays, rental cars, and even merchandise or experiences. Focus on maximizing the value by choosing options that align with your travel preferences.

Example:

- Flight Redemption: Booking a round-trip flight from New York to Paris using airline miles.

2. Flexible Date Searches

Many airlines offer flexible date searches, allowing you to find the best value for your miles. Experiment with different travel dates to identify periods with lower redemption rates, increasing the value of your miles.

Example:

- Flexible Date Search: Finding a flight that requires fewer miles by adjusting travel dates by a day or two.

3. Utilize Mileage Calculators

Mileage calculators provided by airlines can be valuable tools to estimate the number of miles needed for specific flights. This helps you plan and optimize your redemptions, ensuring you get the most value for your miles.

Example:

- Using a mileage calculator to determine the number of miles required for a flight from Chicago to Tokyo.

4. Look for Mileage Sales and Promotions

Airlines occasionally offer mileage sales or promotions, allowing you to purchase additional miles at a discounted rate. This can be an opportunity to top up your mileage balance for a specific redemption.

Example:

- Mileage Sale: Purchasing extra miles during a promotion to reach the required amount for a first-class flight.

5. Consider Partner Airlines

Many airline alliances and partnerships allow you to redeem miles on partner airlines. This expands your travel options and can offer unique experiences not available with the primary airline.

Example:

- Redeeming Delta SkyMiles for a flight on a partner airline within the SkyTeam alliance, such as Air France.

6. Mix Cash and Miles

Some airlines offer the option to use a combination of cash and miles for a single booking. This can be advantageous if you don’t have enough miles for the entire journey or if the cash component provides a better deal.

Example:

- Cash and Miles Option: Paying $100 and using 20,000 miles for a flight that would otherwise cost $300.

7. Explore One-Way Redemptions

Certain airlines allow you to redeem miles for one-way flights, providing flexibility in your travel plans. This is particularly beneficial if you have varying departure and return dates.

Example:

- One-Way Redemption: Booking a one-way flight to Europe using miles and finding an alternative return option with better mileage value.

8. Upgrade to Business or First Class

If you have a substantial mileage balance, consider using miles to upgrade your seat to business or first class. This can be an excellent way to experience luxury travel without the hefty price tag.

Example:

- Seat Upgrade: Upgrading from economy to business class for a long-haul flight using airline miles.

9. Book During Off-Peak Seasons

Redeeming miles during off-peak seasons can result in lower redemption rates. Plan your travel around these periods to maximize the value of your miles.

Example:

- Off-Peak Redemption: Using miles for a beach vacation during a destination’s off-peak season when flights require fewer miles.

10. Stay Informed about Award Charts

Airlines often have award charts that specify the number of miles required for different routes and classes of service. Stay informed about these charts, as they can guide your redemption decisions.

Example:

- Award Chart Reference: Consulting the airline’s award chart to find the most favorable redemption options for specific routes.

By strategically considering these options and examples, you can make the most of your hard-earned airline miles. Whether you’re flying in style in business class, exploring new destinations, or simply enjoying the convenience of redeeming miles for everyday travel, the key is to plan ahead, stay informed, and optimize your redemptions for maximum value.

Case Studies: Success Stories in Travel Rewards

Real-life success stories serve as inspiration for aspiring travelers. Explore examples of individuals who have effectively turned their monthly expenses into dream vacations. Learn from their strategies and apply similar tactics to your own journey.

Real-life success stories in the realm of travel rewards inspire and provide valuable insights into the possibilities of turning ordinary monthly expenses into extraordinary travel experiences. Let’s delve into some compelling case studies where individuals or families leveraged strategic approaches to accumulate and redeem travel rewards effectively.

1. The Family Adventure Enthusiasts

Background: The Johnson family, avid adventure enthusiasts with a passion for exploring national parks, decided to turn their love for travel into a rewards-driven adventure.

Strategy:

- They applied for a travel rewards credit card that offered a generous sign-up bonus and bonus points for travel-related expenses.

- The family strategically used the card for all their monthly expenses, including groceries, gas, and utility bills, maximizing the points earned.

Success:

- Within a year, the Johnsons accumulated enough points to cover flights, accommodations, and rental cars for a cross-country road trip, exploring multiple national parks along the way.

- By leveraging seasonal promotions and taking advantage of partner programs, they stretched their points even further, turning a dream vacation into a reality without a significant financial burden.

2. The Frequent Business Traveler

Background: Sarah, a business professional who frequently traveled for work, decided to capitalize on her work-related expenses to earn travel rewards.

Strategy:

- Sarah signed up for a premium travel rewards credit card that offered perks like airport lounge access, priority boarding, and bonus points for business-related spending.

- She strategically used her credit card for work-related travel expenses, accumulating points not only from flights but also from hotel stays, meals, and transportation.

Success:

- Sarah accumulated a substantial number of points within a short period, allowing her to redeem them for personal trips and upgrades.

- By optimizing her redemptions during peak travel seasons and taking advantage of partner airlines and hotel chains, Sarah transformed her work-related travels into luxurious vacations at a fraction of the cost.

3. The Gradual Accumulator

Background: Mike, a recent college graduate, wanted to embark on a backpacking journey across Europe but had limited funds.

Strategy:

- Mike started by applying for a student-friendly travel rewards credit card with no annual fee and a modest sign-up bonus.

- He used the card responsibly for everyday expenses, gradually accumulating points without overspending.

Success:

- Over the course of two years, Mike accumulated enough points to cover a round-trip flight to Europe and several nights in budget-friendly accommodations.

- By being flexible with travel dates and exploring off-the-beaten-path destinations, Mike transformed his gradual point accumulation into a memorable and cost-effective backpacking adventure through Europe.

4. The Strategic Honeymooners

Background: John and Emily, a newly engaged couple, dreamt of a dream honeymoon without breaking the bank.

Strategy:

- The couple researched and chose a credit card that offered a substantial sign-up bonus and perks tailored to honeymooners, such as hotel upgrades and travel insurance.

- They used the card for wedding-related expenses, strategically timing their applications to align with larger spending periods.

Success:

- John and Emily not only earned enough points to cover their flights and accommodations but also took advantage of complimentary honeymoon packages offered by partner hotels.

- By meticulously planning their itinerary and redeeming points during promotions, they enjoyed a luxurious honeymoon in their dream destination without the financial strain.

These case studies showcase the diverse ways individuals and families can leverage travel rewards to achieve their specific goals. Whether it’s a family road trip, luxury business travel, budget backpacking, or a dream honeymoon, strategic planning, responsible credit card use, and knowledge of loyalty programs can turn aspirations into reality. These success stories highlight that with dedication, patience, and a bit of savvy, anyone can transform their ordinary monthly expenses into extraordinary travel adventures.

Creating a Travel Fund: Turning Dreams into Reality

Take a proactive approach to building a dedicated travel fund. Consider additional ways to save money, such as cutting unnecessary expenses or exploring side hustles. A separate fund ensures that your travel goals remain a financial priority.

Creating a dedicated travel fund is the cornerstone of turning your ordinary monthly expenses into unforgettable travel experiences. By strategically setting aside funds and incorporating smart financial practices, you can make your travel dreams a reality. Let’s explore this process with real-world examples.

1. Assessing Current Finances

Example:

- Monthly Income: $4,000

- Fixed Expenses (Rent, Utilities, etc.): $1,800

- Discretionary Spending (Groceries, Entertainment, etc.): $1,000

- Remaining Capacity for Travel Fund: $1,200

2. Setting Clear Travel Goals

Example:

- Travel Goal: A week-long vacation to Hawaii in 12 months.

3. Determining Monthly Contribution

Example:

- Monthly Travel Fund Contribution: $100

- This contribution ensures that, within 12 months, you’ll have $1,200, enough to cover your Hawaii vacation.

4. Creating a Separate Savings Account

Example:

- Opening a “Hawaii Vacation Fund” savings account.

- Having a designated account helps maintain transparency and prevents accidental spending of earmarked funds.

5. Adjusting Spending Habits

Example:

- Reducing dining out and entertainment expenses by $50 each.

- Making small adjustments in discretionary spending allows for a more substantial contribution to the travel fund without compromising daily life.

6. Exploring Cost-Cutting Measures

Example:

- Switching to a more cost-effective cell phone plan, saving an extra $20 per month.

- Identifying areas where expenses can be reduced increases the monthly allocation to the travel fund.

7. Automating Contributions

Example:

- Setting up an automatic transfer of $100 to the travel fund each month.

- Automation ensures consistent contributions, making it easier to stick to the savings plan.

8. Taking Advantage of Windfalls

Example:

- Directing tax refunds, work bonuses, or unexpected cash gifts to the travel fund.

- Using unexpected windfalls accelerates the growth of the fund without affecting regular budgeting.

9. Planning for Seasonal Expenses

Example:

- Allocating a portion of holiday bonuses for the travel fund.

- Recognizing and planning for seasonal income boosts prevents overspending during special occasions and contributes to the travel fund.

10. Monitoring and Adjusting

Example:

- Regularly reviewing the budget and adjusting contributions based on changes in income or expenses.

- Staying proactive ensures that the travel fund remains aligned with financial circumstances.

11. Exploring Side Hustles for Additional Income

Example:

- Taking on a part-time gig or freelancing to generate additional income.

- Exploring side hustles provides an extra income stream dedicated to the travel fund.

12. Utilizing Travel-Specific Credit Cards

Example:

- Using a travel rewards credit card for regular expenses, earning points for future trips.

- Selecting credit cards with travel-related rewards enhances the travel fund by accumulating points and miles.

13. Adjusting Contributions Based on Travel Goals

Example:

- Increasing monthly contributions in the months leading up to the trip to expedite fund growth.

- Being flexible with contributions allows for dynamic adjustments based on upcoming travel plans.

14. Celebrating Milestones

Example:

- Setting mini-goals and celebrating milestones in the fund’s growth.

- Recognizing achievements along the way provides motivation and reinforces the importance of the travel fund.

15. Reaping the Rewards

Example:

- Booking the Hawaii vacation using the accumulated funds.

- The culmination of consistent contributions and strategic planning results in the realization of the travel goal.

Creating a travel fund is a dynamic and rewarding process that involves strategic financial planning, discipline, and a commitment to your travel aspirations. By implementing these examples and tailoring them to your specific circumstances, you can build a robust travel fund that transforms your dreams into tangible and unforgettable experiences.

Building a Travel Community: Sharing Adventures and Creating Connections

Joining online forums and communities dedicated to travel enthusiasts provides a wealth of knowledge. Connect with like-minded individuals, share your experiences, and gain insights into the latest trends and opportunities in the world of travel rewards.

Building a travel community not only enriches your own wanderlust but also opens doors to new experiences, insights, and lifelong connections. It’s about creating a space where fellow travel enthusiasts can share stories, exchange tips, and inspire each other to explore the world. Let’s explore how to build a vibrant travel community with real-world examples.

1. Establishing a Platform

Example:

- Creating a travel blog or Instagram account dedicated to documenting your journeys.

- A platform serves as the central hub for your travel community, where you can share your experiences and connect with like-minded individuals.

2. Engaging Content Creation

Example:

- Regularly posting detailed travel guides, personal anecdotes, and stunning photos.

- Engaging content is the heartbeat of a travel community, attracting followers and sparking conversations about destinations, cultures, and travel hacks.

3. Encouraging User-Generated Content

Example:

- Running photo contests or travel story submissions.

- Inviting your community to contribute their content fosters a sense of involvement and diversity within the community.

4. Interactive Social Media Platforms

Example:

- Creating a Facebook group or Twitter chat for real-time conversations.

- Social media platforms offer a space for members to share quick updates, ask questions, and engage in ongoing discussions.

5. Hosting Virtual Events

Example:

- Organizing virtual meetups, webinars, or live Q&A sessions.

- Virtual events create opportunities for members to connect, share experiences, and learn from each other, transcending geographical barriers.

6. Collaborating with Other Travel Enthusiasts

Example:

- Collaborating on content or hosting joint events with fellow travel bloggers.

- Partnering with others amplifies your community’s reach and introduces diverse perspectives.

7. Providing Practical Tips and Advice

Example:

- Sharing budgeting tips, travel itineraries, and destination-specific advice.

- Offering practical information establishes your community as a valuable resource for travel enthusiasts at all levels.

8. Creating Specialized Sub-Groups

Example:

- Establishing sub-groups for specific interests like solo travel, adventure trips, or luxury experiences.

- Catering to diverse interests ensures that every member finds a niche within the community.

9. Facilitating Member Meetups

Example:

- Organizing in-person or virtual meetups for community members in the same location.

- Member meetups strengthen connections and allow for face-to-face interactions, fostering a sense of camaraderie.

10. Highlighting Member Spotlights

Example:

- Featuring community members and their travel stories on your platform.

- Recognizing and celebrating individual members brings a personal touch to the community and motivates others to share their experiences.

11. Utilizing Hashtags for Visibility

Example:

- Creating and promoting a unique community hashtag.

- Hashtags make it easy for members to find and engage with community content across various social media platforms.

12. Encouraging Diversity and Inclusion

Example:

- Proactively seeking and sharing stories from diverse backgrounds and perspectives.

- Fostering an inclusive environment ensures that your community is representative of the global tapestry of travel experiences.

13. Moderating and Nurturing Conversations

Example:

- Having community guidelines that encourage positive interactions and respectful discussions.

- A well-moderated community ensures that conversations remain constructive and supportive.

14. Showcasing Behind-the-Scenes Moments

Example:

- Sharing candid moments, challenges, and personal reflections about your travels.

- Offering a glimpse into your own journey humanizes the community and makes it more relatable.

15. Celebrating Community Milestones

Example:

- Marking anniversaries, hitting follower milestones, or recognizing community achievements.

- Celebrating milestones reinforces the sense of community accomplishment and unity.

Building a travel community is an ongoing process that requires dedication, authenticity, and a genuine passion for exploration. By incorporating these examples and tailoring them to your unique style and goals, you can create a vibrant and supportive travel community that not only enhances your personal adventures but also serves as a source of inspiration for others.

Staying Updated on Travel Deals: Navigating the World of Savings

To stay ahead in the world of travel rewards, subscribe to newsletters and alerts from airlines, credit card companies, and travel deal websites. Being proactive in seeking out promotions ensures you never miss a chance to boost your miles balance.

Keeping abreast of the latest travel deals is essential for maximizing your adventures while minimizing your expenses. Whether it’s discounted flights, hotel promotions, or package deals, staying informed ensures you make the most of your travel budget. Let’s explore how you can stay updated on travel deals with real-world examples.

1. Subscribe to Travel Deal Newsletters

Example:

- Signing up for newsletters from travel deal platforms like Travelzoo, Scott’s Cheap Flights, or The Points Guy.

- Subscribing to newsletters provides you with regular updates on the latest travel deals, promotions, and exclusive discounts directly in your inbox.

2. Follow Travel Deal Blogs

Example:

- Reading travel deal blogs that curate and share the best offers, such as The Flight Deal or Secret Flying.

- Blogs often provide detailed insights into specific deals, offering tips on how to maximize savings and take advantage of limited-time promotions.

3. Set Up Price Alerts

Example:

- Using online tools like Google Flights or Skyscanner to set up price alerts for specific routes.

- Price alerts notify you when there’s a significant drop in airfare, allowing you to book at the most opportune time.

4. Join Travel Deal Forums

Example:

- Participating in forums like FlyerTalk or Reddit’s r/TravelDeals to share and discover deals with a community of savvy travelers.

- Forums offer a collective knowledge base, where members share firsthand experiences and insights into the latest travel promotions.

5. Leverage Social Media Platforms

Example:

- Following travel deal accounts on Twitter, Instagram, and Facebook.

- Many travel deal experts and companies share flash sales and time-sensitive offers on social media platforms, allowing you to stay in the loop in real-time.

6. Utilize Travel Deal Apps

Example:

- Downloading apps like Hopper, Kayak, or Skyscanner that provide real-time alerts and insights on flight and hotel prices.

- Mobile apps offer convenient access to travel deals, allowing you to make quick decisions on-the-go.

7. Sign Up for Airline Alerts

Example:

- Registering for fare alerts from your preferred airlines.

- Airlines often send out exclusive deals and promotions to subscribers, ensuring you’re among the first to know about discounted flights.

8. Monitor Flash Sale Websites

Example:

- Regularly checking flash sale websites like Groupon Getaways or Travel Pirates.

- Flash sale platforms offer limited-time deals on vacation packages, accommodations, and activities, providing substantial savings.

9. Join Loyalty Programs for Exclusive Offers

Example:

- Enrolling in airline, hotel, and credit card loyalty programs to receive members-only promotions.

- Loyalty programs often extend special deals and bonuses to their members, enhancing the overall value of your travel experience.

10. Attend Travel Expos and Events

Example:

- Participating in travel expos or industry events where companies showcase exclusive deals.

- These events provide an opportunity to access promotions that might not be widely advertised.

11. Follow Deal Aggregator Websites

Example:

- Browsing deal aggregator websites like DealNews or CheapTickets for comprehensive lists of the latest travel deals.

- Aggregator sites compile various deals from different sources, offering a centralized platform for deal-hunting.

12. Stay Flexible with Travel Dates

Example:

- Being open to flexible travel dates to take advantage of off-peak pricing and last-minute deals.

- Flexibility in your travel plans allows you to capitalize on unexpected opportunities and savings.

13. Explore Package Deals

Example:

- Checking travel agency websites for bundled deals that include flights, accommodations, and activities.

- Packages often provide significant discounts compared to booking each component separately.

14. Download Cashback and Rewards Apps

Example:

- Using cashback and rewards apps like Rakuten or Honey when booking travel.

- These apps offer cashback or points for online purchases, adding an extra layer of savings to your travel expenses.

15. Monitor Airline Sales Cycles

Example:

- Understanding the typical sales cycles of airlines and booking during anticipated sale periods.

- Many airlines have predictable sale seasons, such as Black Friday or New Year’s sales, where you can secure discounted fares.

By incorporating these examples into your travel deal hunting strategy, you can ensure that you’re always in the know when it comes to opportunities for savings. Whether you’re planning a spontaneous getaway or aiming to secure the best possible price for a dream vacation, staying updated on travel deals puts you in control of your travel budget and allows you to make the most of every adventure.

Conclusion

Converting your ordinary monthly expenses into free airfare is not just a possibility; it’s a tangible reality for those willing to embrace the world of travel rewards. By understanding the intricacies of loyalty programs, choosing the right credit card, and adopting savvy spending habits, you can turn your wanderlust into a budget-friendly adventure.

Frequently Asked Questions (FAQs)

- Is it really possible to get free airfare through credit card rewards?

- Absolutely! Many credit cards offer lucrative rewards programs that can be redeemed for free flights.

- How can I avoid getting into debt while using credit cards for travel rewards?

- Practice responsible credit card use by paying your balance in full each month and avoiding unnecessary expenses.

- What are some common mistakes people make when trying to earn travel rewards?

- Common mistakes include not researching credit card terms, overspending to earn rewards, and neglecting to track and redeem points.

- Are there any restrictions on redeeming airline miles for flights?

- Redemption options vary by airline, but in general, there may be blackout dates, limited seat availability, and certain restrictions during peak travel times.

- Can I use travel rewards for more than just flights?

- Yes, most travel rewards programs allow you to redeem points for hotel stays, car rentals, and other travel-related expenses.